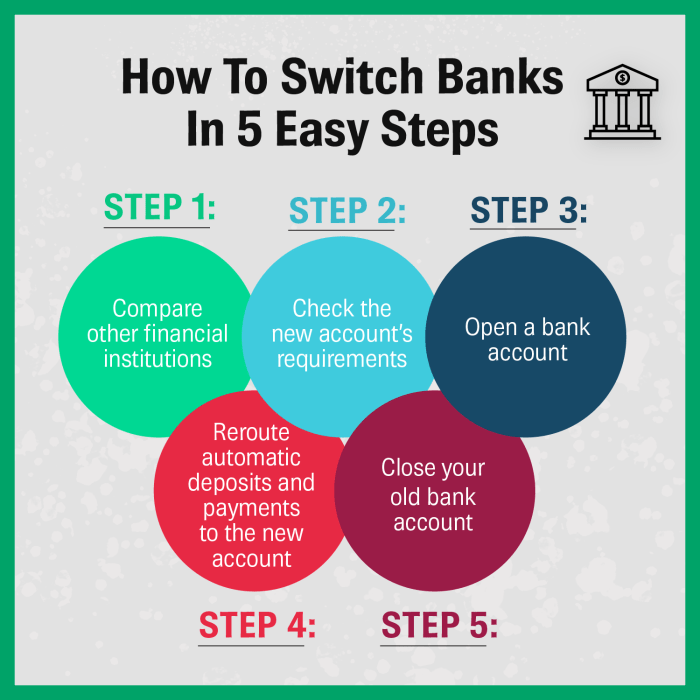

How to switch your bank account: A Complete Guide introduces the essential steps to seamlessly transition to a new bank, offering valuable insights for a hassle-free process. Dive into this comprehensive guide to make the switch with confidence and ease.

In today’s fast-paced world, changing your bank account may seem daunting, but with the right information and guidance, it can be a smooth and straightforward process.

Gather Necessary Information

When switching your bank account, it is crucial to have all the necessary information ready to ensure a smooth transition. This includes providing the new bank with the required documents and details for account setup.

List of Documents Needed:

- Valid government-issued photo ID (driver’s license, passport, etc.)

- Social Security number

- Proof of address (utility bill, lease agreement, etc.)

- Previous bank account details (account number, routing number, etc.)

- Employment information (pay stubs, employer contact details, etc.)

Importance of Having All Required Information:

It is essential to have all the necessary information ready when switching your bank account to avoid any delays or issues during the process. Providing accurate and complete details ensures that your new account is set up correctly and that your financial transactions are not interrupted.

Tips on Organizing and Storing Sensitive Documents Securely:

- Invest in a secure storage solution such as a lockbox or safe to store important documents.

- Consider digitizing your documents and storing them in a secure, password-protected digital folder.

- Avoid carrying sensitive documents with you unless absolutely necessary, and keep them in a secure place at home.

- Regularly review and update your document storage system to ensure that all information is current and easily accessible when needed.

Research Potential New Banks

When looking to switch your bank account, it is important to research potential new banks to find the best fit for your financial needs. Consider the following factors when selecting a new bank:

Types of Accounts Offered

- Checking Accounts: These are ideal for everyday transactions and may come with features like online banking and mobile apps.

- Savings Accounts: Offer higher interest rates to help you grow your savings over time.

- Money Market Accounts: Combine features of both checking and savings accounts, usually offering higher interest rates.

- Certificate of Deposit (CD): A fixed-term deposit that earns higher interest, but requires you to leave your money untouched for a specific period.

Importance of Reading Reviews

Before making a decision, it is crucial to read reviews and research the reputation of the bank you are considering. Reviews can provide insights into the customer service, fees, and overall satisfaction of current account holders. Researching the bank’s reputation can help you determine if they have a history of good financial practices and customer trust.

Open a New Account

When opening a new bank account, there are several important steps to follow. It is crucial to choose a bank that meets your financial needs and offers the services you require. Once you have selected a new bank, you can begin the process of opening an account.

Steps Involved in Opening a New Bank Account

- Gather all necessary documents, such as identification, proof of address, and social security number.

- Visit the bank in person or apply online, depending on the bank’s procedures.

- Fill out the required forms and provide the necessary information to open the account.

- Make an initial deposit to fund the account.

- Set up any additional services or features you may need, such as online banking or direct deposit.

Transferring Funds from the Old Account to the New One

- Link your old account to your new account for easy transfer of funds.

- Initiate a transfer through online banking, mobile app, or by visiting a branch.

- Verify the transfer has been completed successfully and monitor your accounts to ensure all funds have been moved.

Importance of Understanding Fees and Account Terms Before Opening a New Account

Before opening a new bank account, it is crucial to understand the fees and terms associated with the account. This includes monthly maintenance fees, overdraft fees, minimum balance requirements, and any other charges that may apply. By understanding these fees upfront, you can avoid surprises and ensure that the account meets your financial needs.

Update Your Direct Deposits and Automatic Payments: How To Switch Your Bank Account

When switching your bank account, it’s crucial to update your direct deposits and automatic payments to avoid any disruptions in your financial transactions. Here’s how you can ensure a smooth transition:

Update Direct Deposits

To update your direct deposits, make sure to notify the following sources with your new account information:

- Your employer for your salary deposits

- Social Security Administration if you receive benefits

- Any other sources of direct deposits such as rental income or investment dividends

Update Automatic Bill Payments

To update automatic bill payments, follow these steps:

- Identify all your automatic bill payments linked to your old account

- Contact each biller or service provider to update your payment information with your new account details

- Verify that the changes have been successfully processed to avoid any missed payments

Importance of a Smooth Transition

Ensuring a smooth transition for your recurring payments is essential to avoid late fees, penalties, or service disruptions. By promptly updating your direct deposits and automatic bill payments with your new account information, you can maintain financial stability and avoid any negative consequences of missed payments.

Close Your Old Account

When it comes to closing your old bank account, there are specific steps you should follow to ensure a smooth transition. It’s important to handle this process properly to avoid any potential issues in the future.

To close your old account properly, you should start by contacting your bank either in person, over the phone, or through their online portal. Inform them of your intention to close the account and follow their specific procedures for doing so. Some banks may require you to submit a written request or fill out a form.

Potential Fees or Consequences, How to switch your bank account

Before closing your old account, be sure to check for any potential fees or consequences that may apply. Some banks charge a fee for closing an account within a certain timeframe of opening it. Additionally, leaving an account open with a zero balance could result in maintenance fees or other charges over time. It’s essential to understand your bank’s policies to avoid any surprises.

Verifying Transactions

To ensure that all transactions have cleared before closing your account, review your recent statements and account activity. Make sure that all outstanding checks have been processed, and all pending transactions have been completed. It’s also a good idea to update your new account information with any recurring payments or direct deposits to prevent any missed transactions.

Remember to obtain confirmation from your bank that your old account has been successfully closed to avoid any lingering issues. By following these steps and staying informed about potential fees or consequences, you can close your old account properly and transition smoothly to your new banking relationship.

In conclusion, switching your bank account involves careful planning, research, and attention to detail. By following the Artikeld steps and tips, you can navigate this transition successfully and enjoy the benefits of your new banking relationship. Make the switch today and take control of your financial future!