Retirement savings options for self-employed individuals sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with semrush author style and brimming with originality from the outset.

Exploring the various retirement account options, setting up a plan, investment strategies, and tax implications, this guide delves into the key aspects of securing a financially stable retirement for self-employed individuals.

Retirement account options for self-employed individuals

When it comes to retirement savings, self-employed individuals have several options to choose from to ensure a secure financial future. Understanding the features and benefits of each type of retirement account can help individuals make informed decisions based on their unique financial goals and circumstances.

SEP IRAs

SEP IRAs, or Simplified Employee Pension Individual Retirement Accounts, are a popular choice for self-employed individuals and small business owners. Here are some key features and benefits of SEP IRAs:

- Employer contributions: Employers can make tax-deductible contributions to SEP IRAs on behalf of themselves and their employees.

- Contribution limits: Contributions are based on a percentage of income, up to a certain limit set by the IRS.

- Tax advantages: Contributions are tax-deductible, and investment earnings grow tax-deferred until withdrawal.

Solo 401(k)s

Solo 401(k)s, also known as Individual 401(k)s or One-Participant 401(k)s, offer another retirement savings option for self-employed individuals. Here are some key features and benefits of Solo 401(k)s:

- Higher contribution limits: Solo 401(k)s allow for higher contribution limits compared to SEP IRAs, especially for those with higher incomes.

- Employer and employee contributions: Individuals can contribute as both the employer and employee, maximizing retirement savings potential.

- Loan options: Solo 401(k)s may offer loan options for individuals in need of financial flexibility.

SIMPLE IRAs

SIMPLE IRAs, or Savings Incentive Match Plan for Employees Individual Retirement Accounts, are another retirement account option for self-employed individuals with a small number of employees. Here are some key features and benefits of SIMPLE IRAs:

- Easy to set up: SIMPLE IRAs are easy to establish and maintain, making them a convenient option for small businesses.

- Employer contributions: Employers are required to make either a matching contribution or non-elective contribution to employees’ accounts.

- Contribution limits: Contribution limits are lower than Solo 401(k)s but still offer a tax-advantaged way to save for retirement.

Setting up a retirement plan as a self-employed individual

As a self-employed individual, it’s essential to establish a retirement plan to secure your financial future. Setting up a retirement plan can seem daunting, but with the right information, it can be a straightforward process. Here is a step-by-step guide on how self-employed individuals can establish a retirement plan and the eligibility criteria for opening a retirement account.

Step-by-step guide for setting up a retirement plan

- 1. Evaluate your financial situation: Determine how much you can contribute to a retirement plan based on your income and expenses.

- 2. Choose a retirement plan: Research different retirement plans available for self-employed individuals, such as a Solo 401(k), SEP IRA, or SIMPLE IRA.

- 3. Check eligibility: Make sure you meet the eligibility criteria for the chosen retirement plan, including income requirements and contribution limits.

- 4. Open a retirement account: Contact a financial institution or retirement plan provider to open your chosen retirement account.

- 5. Set up automatic contributions: Consider setting up automatic contributions to your retirement account to ensure consistent savings.

- 6. Monitor and adjust: Regularly review your retirement plan and make adjustments as needed based on your financial goals and circumstances.

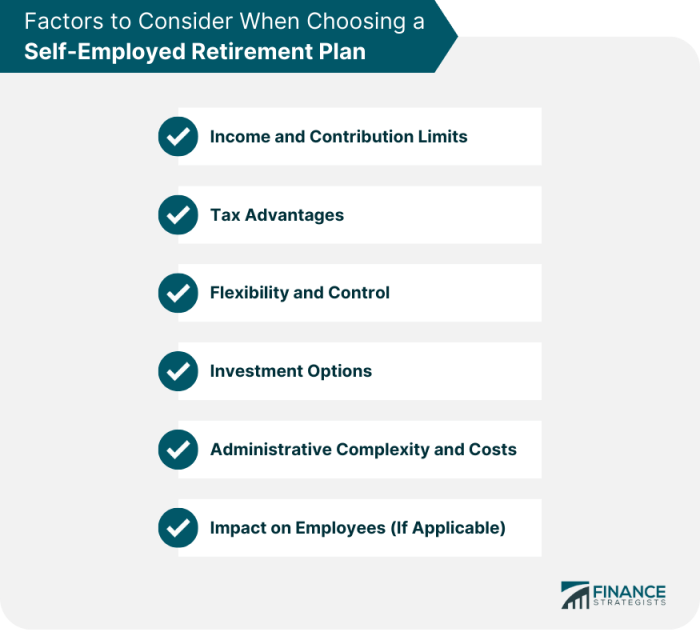

Choosing the right retirement plan based on individual circumstances

- Consider your income level: Depending on your income, you may be eligible for different retirement plans with varying contribution limits.

- Assess your future financial needs: Evaluate your retirement goals and timeline to determine the most suitable retirement plan for your circumstances.

- Compare investment options: Look into the investment options offered by different retirement plans to choose one that aligns with your risk tolerance and financial objectives.

- Seek professional advice: Consult with a financial advisor or tax professional to help you select the best retirement plan for your specific situation.

- Review and adjust as needed: Regularly review your retirement plan and make adjustments as your financial situation changes to ensure you are on track to meet your retirement goals.

Investment strategies for retirement savings: Retirement Savings Options For Self-employed Individuals

When it comes to retirement savings, self-employed individuals have various investment strategies to consider. It is crucial to choose the right mix of investments to help grow your retirement fund over time.

The importance of diversification in retirement portfolios

Diversification is a key strategy for retirement savings as it helps spread risk across different asset classes. By investing in a mix of stocks, bonds, real estate, and other assets, you can reduce the impact of market fluctuations on your overall portfolio. This can help protect your savings and provide more stable returns over the long term.

- Allocate your investments across different asset classes to minimize risk.

- Regularly review and rebalance your portfolio to ensure diversification.

- Consider investing in low-cost index funds or exchange-traded funds (ETFs) for broad market exposure.

Remember, don’t put all your eggs in one basket. Diversification is key to a resilient retirement portfolio.

How risk tolerance should influence investment decisions for retirement savings, Retirement savings options for self-employed individuals

Understanding your risk tolerance is crucial when choosing investment strategies for retirement savings. Your risk tolerance refers to how comfortable you are with the possibility of losing money in exchange for potentially higher returns. It is essential to align your investment choices with your risk tolerance to ensure you can stay invested for the long term.

- Assess your risk tolerance before making investment decisions.

- Choose investments that match your risk tolerance level.

- Consider your investment time horizon and financial goals when determining risk tolerance.

Tax implications of retirement savings for self-employed individuals

When it comes to retirement savings for self-employed individuals, understanding the tax implications is crucial. Contributing to retirement accounts not only helps you secure your financial future but also offers significant tax benefits.

Tax Benefits of Contributing to Retirement Accounts

- Contributions to retirement accounts, such as a SEP IRA or Solo 401(k), are typically tax-deductible. This means that the amount you contribute reduces your taxable income for the year, resulting in lower tax liability.

- By lowering your taxable income through retirement contributions, you not only save for retirement but also reduce your current tax burden. This can lead to substantial savings, especially for self-employed individuals in higher tax brackets.

- Some retirement accounts, like a Roth IRA or Roth Solo 401(k), offer tax-free growth. While contributions to these accounts are made with after-tax dollars, withdrawals during retirement are tax-free, providing valuable tax advantages in the long run.

In conclusion, understanding the diverse retirement savings options available is crucial for self-employed individuals looking to secure their financial future. By making informed decisions and maximizing tax benefits, one can ensure a comfortable retirement that aligns with their goals.

Are you considering switching your bank account? If so, you may want to check out this detailed guide on how to switch your bank account. It covers everything from comparing different banks to the steps involved in transferring your funds seamlessly. Making a switch can be a daunting task, but with the right information, you can navigate the process smoothly.

When it comes to managing your finances, knowing how to switch your bank account can be a game-changer. Whether you’re looking for better interest rates, lower fees, or just a change of scenery, the process doesn’t have to be daunting. By following a few simple steps, you can seamlessly transition to a new bank without any hassle. Check out this detailed guide on how to switch your bank account and make the most out of your banking experience.