Kicking off with Comparing savings account interest rates, this opening paragraph is designed to captivate and engage the readers, setting the tone semrush author style that unfolds with each word.

When it comes to growing your savings, one crucial aspect to consider is the interest rates offered by savings accounts. By comparing these rates, you can potentially unlock significant long-term growth for your funds. Even a small variance in interest rates can have a notable impact on the overall savings over time. Let’s delve deeper into the world of savings account interest rates and how they can influence your financial journey.

Importance of Savings Account Interest Rates

When it comes to maximizing savings, comparing savings account interest rates is crucial. Higher interest rates can lead to significant long-term growth in savings, making it essential to choose an account with the best rates available. Even a small difference in interest rates can have a big impact on the overall savings accumulated over time.

Impact of Interest Rates on Savings Growth

Higher interest rates play a critical role in the growth of savings over time. For example, let’s consider two savings accounts: Account A with an interest rate of 1% and Account B with an interest rate of 2%. If you deposit $10,000 in each account and leave it untouched for 10 years, the difference in interest rates will result in a significant variance in the final savings amount.

- Account A (1% interest rate): After 10 years, the savings balance would be approximately $11,046.

- Account B (2% interest rate): After 10 years, the savings balance would be approximately $12,190.

Factors Affecting Savings Account Interest Rates

When it comes to savings account interest rates, there are several key factors that come into play. These factors can influence how much interest you earn on your savings and are important to consider when choosing a savings account.

Economic Conditions

Economic conditions play a significant role in determining savings account interest rates. When the economy is strong and interest rates are high, banks are more likely to offer higher interest rates on savings accounts to attract deposits. Conversely, during economic downturns or when interest rates are low, savings account interest rates may be lower.

Bank Policies

Each bank has its own policies and strategies when it comes to setting savings account interest rates. Some banks may offer higher interest rates as a way to compete with other financial institutions, while others may prioritize other aspects of their business and offer lower rates. It’s important to shop around and compare rates from different banks to find the best option for your savings.

Account Types

The type of savings account you choose can also impact the interest rate you receive. For example, a high-yield savings account typically offers higher interest rates than a basic savings account. Money market accounts may also offer competitive rates, but they often require higher minimum balances.

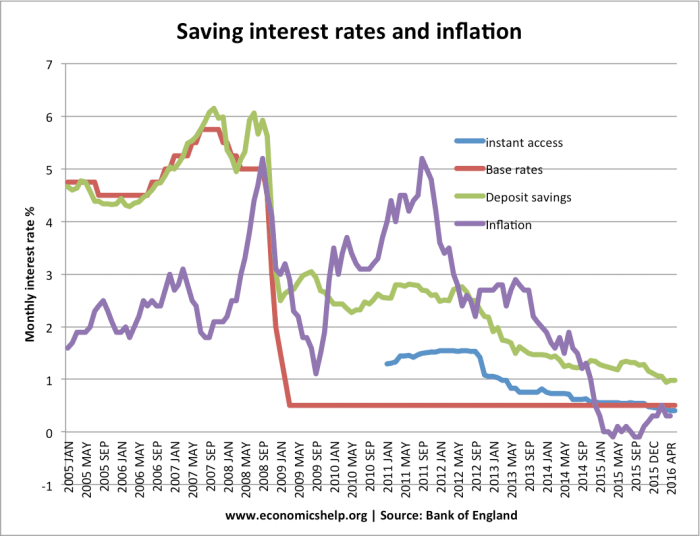

Relationship Between Inflation Rates and Savings Interest Rates, Comparing savings account interest rates

Inflation rates can have a direct impact on savings interest rates. When inflation is high, the purchasing power of money decreases over time. To combat the effects of inflation, banks may adjust savings account interest rates to ensure that the real return on your savings is not eroded by inflation. It’s important to consider inflation rates when evaluating the overall value of the interest earned on your savings.

Types of Savings Accounts: Comparing Savings Account Interest Rates

When it comes to savings accounts, there are several types available in the market, each with its own set of features and benefits. Understanding the differences between basic savings accounts, high-yield savings accounts, and money market accounts can help individuals make informed decisions about where to keep their money.

Basic Savings Accounts

Basic savings accounts are the most common type of savings account offered by banks and credit unions. These accounts typically offer low interest rates, but they are easy to open and maintain. Basic savings accounts are a safe place to keep your money while allowing you to earn some interest on your balance. However, the interest rates on these accounts are usually lower compared to other types of savings accounts.

High-Yield Savings Accounts

High-yield savings accounts, as the name suggests, offer higher interest rates than basic savings accounts. These accounts are often offered by online banks and financial institutions, allowing customers to earn more on their savings. While high-yield savings accounts provide better interest rates, they may have certain requirements such as minimum balance thresholds or limits on the number of withdrawals allowed per month.

Money Market Accounts

Money market accounts are a hybrid between a savings account and a checking account. These accounts typically offer higher interest rates than basic savings accounts but lower than high-yield savings accounts. Money market accounts may require a higher minimum balance to open and maintain the account, but they often provide check-writing capabilities and debit card access for easier access to funds.

Overall, each type of savings account has its own advantages and disadvantages in terms of interest rates and accessibility. It’s important for individuals to consider their financial goals and needs when choosing the right savings account for their money.

How to Compare Savings Account Interest Rates

When comparing savings account interest rates, it’s important to consider various factors to make an informed decision. Here is a step-by-step guide on how to effectively compare savings account interest rates:

1. Research Different Financial Institutions

- Start by researching different financial institutions such as banks, credit unions, and online banks.

- Check their websites or contact them directly to inquire about their current savings account interest rates.

2. Compare Annual Percentage Yield (APY)

- Look for the Annual Percentage Yield (APY) rather than the simple interest rate to get a clearer picture of how much you can earn on your savings.

- Choose the account with the highest APY to maximize your earnings over time.

3. Consider Fees and Minimum Balance Requirements

- Take into account any fees associated with the savings account, such as monthly maintenance fees or overdraft fees.

- Check if there are any minimum balance requirements to avoid additional charges.

4. Read Reviews and Customer Feedback

- Look for reviews and feedback from current customers to get an idea of the level of customer service and overall satisfaction with the financial institution.

- Consider the reputation and reliability of the institution before opening a savings account.

5. Stay Informed About Interest Rate Changes

- Regularly check for updates on interest rate changes to ensure you are getting the best rate for your savings.

- Follow financial news websites or sign up for alerts to stay informed about any fluctuations in interest rates.

In conclusion, understanding how to compare savings account interest rates is key to making informed financial decisions. By keeping an eye on the rates, factors affecting them, and the types of accounts available, you can ensure that your savings work harder for you. Take the time to explore the options, compare the rates, and make the most of your savings potential.