How to invest in index funds sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with semrush author style and brimming with originality from the outset.

Index funds have become a popular choice for investors looking to diversify their portfolios and achieve long-term growth. In this guide, we will explore the ins and outs of investing in index funds, from understanding what they are to choosing the right fund and managing your investments effectively.

What are index funds?: How To Invest In Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. These funds invest in a diversified portfolio of securities that mirror the holdings of the underlying index.

Examples of popular index funds

Some popular index funds in the market include:

– Vanguard 500 Index Fund (VFIAX): Tracks the performance of the S&P 500 index.

– iShares Core S&P 500 ETF (IVV): Also replicates the performance of the S&P 500 index.

– SPDR S&P 500 ETF Trust (SPY): Another fund that aims to mimic the S&P 500 index.

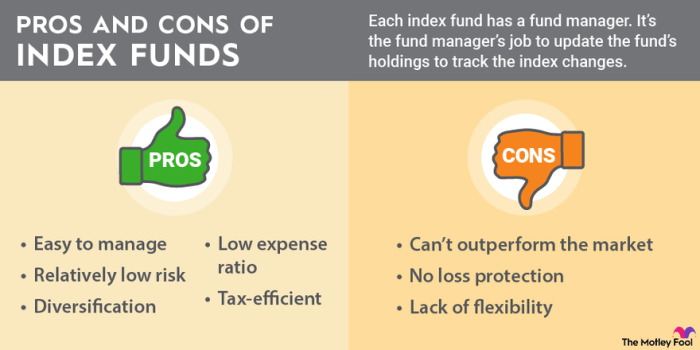

Benefits of investing in index funds compared to individual stocks

- Diversification: Index funds provide instant diversification by investing in a broad range of securities, reducing individual stock risk.

- Lower Costs: Index funds typically have lower expense ratios compared to actively managed funds, leading to higher returns for investors.

- Passive Management: Index funds require minimal supervision as they aim to match the performance of the index, making them a low-maintenance investment option.

- Consistent Performance: Over the long term, index funds have shown to outperform many actively managed funds due to their low costs and broad market exposure.

Comparison of index funds to actively managed funds

- Performance: Studies have shown that index funds tend to outperform actively managed funds over the long term, mainly due to their lower costs and broad market exposure.

- Fees: Index funds generally have lower expense ratios compared to actively managed funds, which can eat into overall returns for investors.

- Risk: Actively managed funds carry the risk of underperformance compared to the market, while index funds provide more consistent returns based on the performance of the underlying index.

How to choose the right index fund?

When selecting an index fund, it is crucial to consider various key factors to ensure that you are making a well-informed decision. Factors such as expense ratios, fund diversification, and historical performance data play a significant role in determining the most suitable index fund for your investment goals.

Importance of Expense Ratios and Fund Diversification

- Expense ratios: These are the fees charged by the fund manager for managing the index fund. Lower expense ratios are generally preferable as they can have a significant impact on your overall returns over time.

- Fund diversification: A well-diversified index fund can help reduce risk by spreading your investment across a wide range of assets. It is essential to consider the level of diversification offered by the index fund you are considering.

Researching and Evaluating Different Index Funds

- Compare expense ratios: Look for index funds with low expense ratios to maximize your returns.

- Consider fund size: Larger funds may offer more stability and liquidity compared to smaller funds.

- Review historical performance: Analyze how the index fund has performed over different time periods to assess its consistency and growth potential.

Analyzing Historical Performance Data

When analyzing historical performance data, look for metrics such as annualized returns, volatility, and Sharpe ratio to gauge the fund’s performance relative to its risk level.

- Review long-term performance: Focus on the fund’s performance over extended periods to understand how it has weathered various market conditions.

- Consider benchmark comparisons: Compare the fund’s performance against relevant benchmarks to assess its ability to outperform the market.

- Understand risk-adjusted returns: Evaluate how the fund has delivered returns in relation to the level of risk taken to achieve those returns.

How to invest in index funds?

Investing in index funds is a straightforward process that can help you grow your wealth over time. Here are some key steps to get started:

Opening an Investment Account

When investing in index funds, the first step is to open an investment account. This can be done through a brokerage firm or an online investment platform. Make sure to choose a reputable and reliable provider that offers index funds as part of their investment options.

Purchasing Index Funds

There are various ways to purchase index funds. You can buy them through a brokerage account, where you can directly invest in specific index funds of your choice. Another option is to invest in index funds through an employer-sponsored retirement plan, such as a 401(k) or 403(b) account.

Determining the Appropriate Investment Amount, How to invest in index funds

When deciding how much to invest in index funds, consider your financial goals, risk tolerance, and investment timeline. It’s important to invest an amount that you are comfortable with and that aligns with your overall financial plan. Start with an amount that you can afford to invest regularly and consistently over time.

Setting Up Automatic Contributions

One strategy to ensure consistent investing in index funds is to set up automatic contributions. This allows you to regularly invest a fixed amount of money from your bank account into your chosen index funds. By automating your investments, you can take advantage of dollar-cost averaging and benefit from market fluctuations over time.

Managing and monitoring index fund investments

Investing in index funds is just the first step towards building a diversified investment portfolio. To ensure long-term success, it is crucial to actively manage and monitor your index fund investments. This involves periodic portfolio reviews, rebalancing, staying informed about market trends, and adjusting investments based on your financial goals and risk tolerance.

The importance of periodic portfolio reviews

Regularly reviewing your investment portfolio is essential to ensure that it aligns with your financial objectives and risk tolerance. By assessing the performance of your index funds and comparing them to your investment goals, you can make informed decisions about whether any adjustments are necessary.

- Review your portfolio at least annually to track performance and make any necessary changes.

- Consider factors such as market conditions, economic outlook, and your long-term financial goals when evaluating your investments.

- Seek professional advice if needed to help you assess your portfolio and make informed decisions.

The role of rebalancing in maintaining a diversified portfolio

Rebalancing involves adjusting the allocation of your investments to maintain a diversified portfolio in line with your risk tolerance and investment goals. This ensures that you are not overexposed to any particular asset class and helps manage risk over time.

- Set a schedule for rebalancing your portfolio, such as quarterly or annually, to keep your asset allocation on track.

- Consider selling overperforming assets and buying underperforming ones to maintain a balanced portfolio.

- Reevaluate your risk tolerance and investment objectives periodically to determine if any changes to your asset allocation are necessary.

Tips on staying informed about market trends and economic indicators

Keeping up-to-date with market trends and economic indicators is crucial for making informed investment decisions. By staying informed, you can adjust your index fund investments based on changing market conditions and potential opportunities.

- Follow financial news outlets, websites, and publications to stay informed about market developments.

- Monitor economic indicators such as GDP growth, inflation rates, and interest rates to gauge the overall health of the economy.

- Attend seminars, webinars, or workshops to gain insights from investment professionals and stay abreast of industry trends.

Best practices for adjusting investments based on financial goals and risk tolerance

Adjusting your index fund investments to align with your financial goals and risk tolerance is essential for long-term investment success. By following best practices, you can ensure that your portfolio remains well-suited to your individual circumstances.

- Regularly reassess your financial goals and risk tolerance to determine if any adjustments to your investments are necessary.

- Consult with a financial advisor to help you create a personalized investment strategy that meets your objectives.

- Consider factors such as your time horizon, liquidity needs, and investment preferences when making changes to your portfolio.

In conclusion, investing in index funds can be a smart and efficient way to build wealth over time. By following the strategies Artikeld in this guide, you can take control of your financial future and work towards your investment goals with confidence.

When it comes to managing your finances, one key aspect to consider is comparing savings account interest rates. By doing so, you can ensure that your money is working as hard as possible for you. To learn more about the importance of comparing savings account interest rates, check out this informative article on Comparing savings account interest rates.

When it comes to financial planning, comparing savings account interest rates is crucial for maximizing your returns. It’s important to research and analyze different options to ensure you’re getting the best rate possible. By visiting Comparing savings account interest rates , you can easily compare various banks and financial institutions to find the most competitive rates available. Stay informed and make informed decisions to help your money grow.