How to invest in startups and venture capital – this guide delves into the realm of startup investing and venture capital, exploring the nuances, risks, and rewards that come with these dynamic investment opportunities. Get ready to uncover the secrets to success in the startup ecosystem.

Startup investing and venture capital have become increasingly popular avenues for investors looking to diversify their portfolios and support innovative companies. This guide will equip you with the knowledge and tools needed to navigate this exciting but complex landscape effectively.

Introduction to Startup Investing

Startup investing involves providing financial support to early-stage companies in exchange for equity. This type of investment is considered high-risk but also has the potential for high returns. Here, we will explore the basics of startup investing and how it differs from traditional investments.

Difference Between Startups and Traditional Investments

- Startups: Startups are newly established companies with innovative ideas or products aiming for rapid growth. These companies may not have a proven track record or revenue but offer high growth potential.

- Traditional Investments: Traditional investments typically involve investing in established companies with a solid track record, steady revenue streams, and lower growth potential compared to startups.

Potential Risks and Rewards of Investing in Startups

- Rewards: Investing in startups can potentially lead to significant returns if the company experiences rapid growth and success. Early investors in successful startups can benefit from high returns on their initial investment.

- Risks: Startup investing is inherently risky, as many startups fail within the first few years of operation. Investors may lose their entire investment if the startup fails to succeed or attract additional funding.

Understanding Venture Capital: How To Invest In Startups And Venture Capital

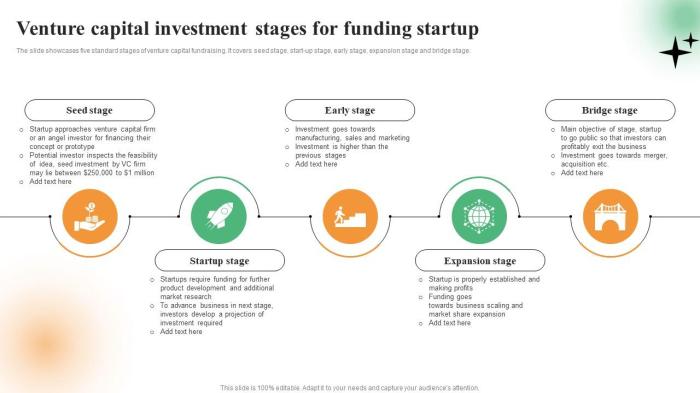

Venture capital plays a crucial role in the startup ecosystem by providing funding to early-stage companies with high growth potential. This form of financing is typically provided by professional investors in exchange for equity ownership in the startup.

Key Players in the Venture Capital Ecosystem, How to invest in startups and venture capital

In the venture capital ecosystem, there are several key players involved in the funding process. These include:

- Venture Capital Firms: These are investment firms that raise funds from institutional investors, such as pension funds, endowments, and high-net-worth individuals, to invest in startups.

- Angel Investors: Individual investors who provide capital to startups in exchange for equity. They often invest in the early stages of a company’s development.

- Corporate Venture Capital: This involves investment by large corporations in startups that are strategically relevant to their business interests.

Venture capital firms play a critical role in nurturing and supporting the growth of innovative startups.

How Venture Capital Firms Select and Invest in Startups

Venture capital firms follow a rigorous process to select and invest in startups. This typically involves:

- Deal Sourcing: Venture capital firms identify potential investment opportunities through various channels, such as referrals, networking events, and pitch competitions.

- Due Diligence: Extensive research and analysis are conducted to assess the viability and potential of the startup, including market opportunity, team capabilities, and business model.

- Term Sheet: If the due diligence process is successful, a term sheet outlining the terms of the investment is presented to the startup founders.

- Investment: Once the term sheet is agreed upon, the venture capital firm invests capital in the startup in exchange for equity ownership.

Overall, venture capital plays a critical role in fueling innovation and driving economic growth by supporting the development of high-potential startups.

Researching Potential Investments

Researching potential investments in startups is crucial to make informed decisions and maximize returns on your investments. Due diligence is essential before committing your capital to any startup opportunity. Here, we will discuss methods for researching and evaluating startup opportunities, the importance of due diligence, and the criteria for selecting promising startup investments.

Methods for Researching and Evaluating Startup Opportunities

- Conduct thorough market research to understand the industry landscape, target audience, and potential competitors.

- Review the startup’s business model, revenue streams, and growth projections to assess its viability and scalability.

- Analyze the founding team’s experience, skills, and track record to determine their ability to execute the business plan.

- Seek feedback from industry experts, mentors, and other investors to gain different perspectives on the startup.

The Importance of Due Diligence

- Due diligence helps investors uncover potential risks, challenges, and opportunities associated with a startup investment.

- It allows investors to verify the accuracy of information provided by the startup and assess its financial health and legal compliance.

- By conducting due diligence, investors can mitigate risks and make more informed investment decisions.

Criteria for Selecting Promising Startup Investments

- Evaluate the startup’s market potential, competitive advantage, and unique value proposition in the market.

- Assess the scalability of the startup’s business model and its ability to generate sustainable revenue growth.

- Consider the founding team’s expertise, passion, and commitment to the startup’s success.

- Look for startups with a clear go-to-market strategy, customer acquisition plan, and milestones for growth.

Investment Strategies in Startups

Investing in startups can be a lucrative but risky endeavor. It is essential to understand the various investment strategies available and how to effectively diversify your portfolio to mitigate risks and maximize returns.

Angel Investing

Angel investing involves high-net-worth individuals providing capital to startups in exchange for ownership equity. This strategy allows investors to have a more hands-on approach and potentially earn significant returns if the startup succeeds. However, it also comes with high risks due to the early-stage nature of the investments.

Crowdfunding

Crowdfunding platforms enable individuals to invest small amounts of money in a startup to help them raise capital. This strategy allows for a more diversified investment approach as you can invest in multiple startups with relatively lower capital. However, it may lack the personalized involvement of angel investing.

Accelerators

Accelerators are programs that provide startups with mentorship, resources, and funding in exchange for equity. Investing in startups that have gone through accelerator programs can be beneficial as they are more likely to have a solid foundation and support network for growth. However, the competition to invest in these startups can be fierce.

Creating a Diversified Startup Investment Portfolio

To create a diversified startup investment portfolio, it is essential to spread your investments across different industries, stages of development, and investment strategies. By diversifying your portfolio, you can reduce the overall risk and increase the chances of having successful investments that can offset any losses.

Importance of Sector Analysis in Startup Investing

Sector analysis plays a crucial role in startup investing as different industries have varying levels of risk and potential for growth. By conducting thorough research and analysis of the sector in which a startup operates, investors can make more informed decisions and identify opportunities for investment that align with their risk tolerance and investment goals.

Legal and Financial Considerations

Investing in startups involves legal and financial considerations that are crucial for protecting your investments and mitigating risks. Understanding the typical terms of a startup investment deal is essential to make informed decisions.

Typical Terms of a Startup Investment Deal

- Equity: Investors typically receive equity in the startup in exchange for their investment. This gives them ownership and a stake in the company.

- Valuation: The valuation of the startup determines the price at which investors buy equity. It is crucial to assess the startup’s valuation to understand the potential for returns.

- Vesting: Vesting schedules determine when investors can fully own their equity. This helps align the interests of investors and founders over time.

- Exit Strategy: Investors should consider the startup’s exit strategy, whether it involves an acquisition, IPO, or other means of providing returns on investment.

Mitigating Risks and Protecting Investments

- Due Diligence: Conduct thorough due diligence on the startup, its founders, market potential, and financials to assess risks and opportunities.

- Diversification: Diversifying your startup investments across different industries and stages can help mitigate risks associated with individual startups.

- Legal Counsel: Seek legal advice to review investment agreements, terms, and conditions to ensure your rights are protected as an investor.

- Insurance: Consider insurance options that can help protect your investments in case of unforeseen events or startup failures.

In conclusion, investing in startups and venture capital can be a lucrative yet challenging endeavor. By following the strategies and considerations Artikeld in this guide, you can make informed decisions and maximize your chances of success in this competitive market. Start your investment journey today and watch your portfolio grow with promising startup ventures.

When it comes to buying a house, saving for a down payment is crucial. One effective way to achieve this goal is by creating a budget and cutting unnecessary expenses. Consider setting up a separate savings account specifically for your down payment fund. Additionally, you can explore options such as investing in high-yield savings accounts or cutting back on luxury expenses.

To learn more about how to save for a down payment on a house, check out this detailed guide How to save for a down payment on a house.

When it comes to buying a house, one of the biggest challenges is saving for a down payment. There are several strategies you can use to help you reach your goal. From setting a budget and cutting unnecessary expenses to exploring down payment assistance programs, there are many ways to save up for that initial investment. Check out this detailed guide on How to save for a down payment on a house for more tips and tricks.