What are bonds and how do they work sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with semrush author style and brimming with originality from the outset.

Bonds play a crucial role in the financial market, serving as debt instruments issued by governments and corporations to raise capital. Understanding how bonds function and the various types available is essential for investors looking to diversify their portfolios.

What are bonds?

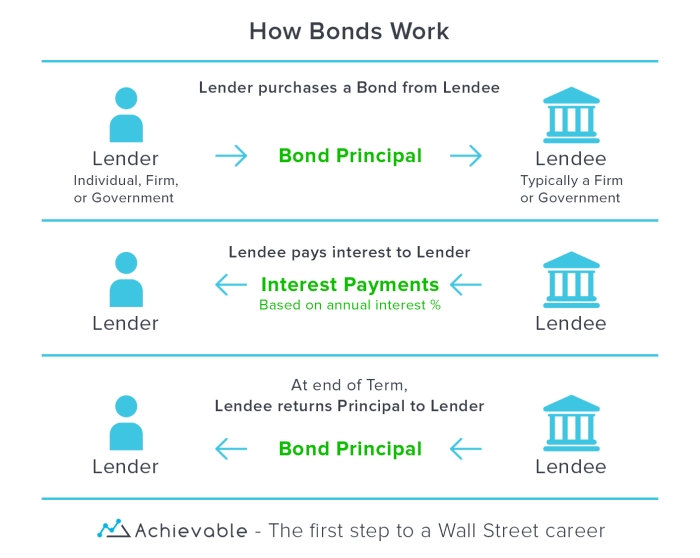

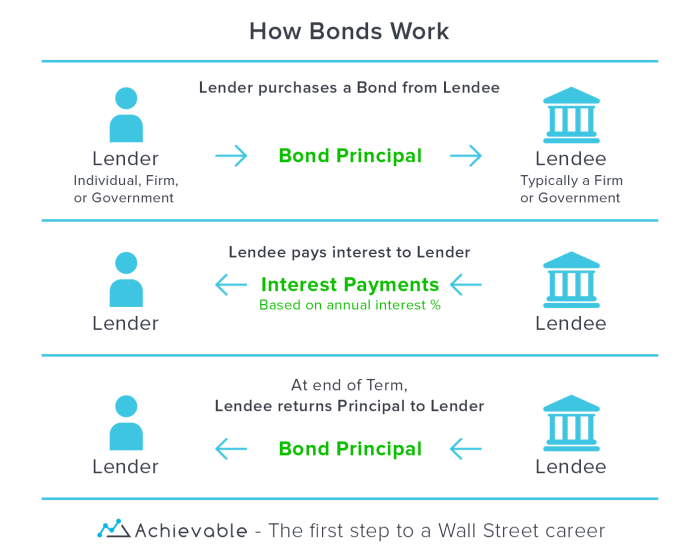

Bonds are financial instruments used by governments, municipalities, and corporations to raise capital. Essentially, bonds represent a loan made by an investor to the bond issuer. In return, the issuer promises to pay back the principal amount on a specified maturity date, along with periodic interest payments.

Types of Bonds

- Government Bonds: Issued by governments to finance public projects or manage debt. Examples include U.S. Treasury bonds and savings bonds.

- Corporate Bonds: Issued by corporations to fund operations, expansions, or acquisitions. These bonds offer higher yields but also come with higher risk compared to government bonds.

- Municipal Bonds: Issued by state or local governments to fund infrastructure projects like schools, roads, and hospitals. Interest earned on municipal bonds is often tax-exempt at the federal level.

How do bonds work?

When it comes to bonds, they function as loans where investors lend money to issuers in exchange for periodic interest payments. This means that investors essentially act as creditors to the issuer.

Explain the relationship between bond prices, interest rates, and yields:

Relationship between bond prices, interest rates, and yields

- Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall, and vice versa.

- The yield of a bond is influenced by both its coupon rate and the price at which it was purchased.

- A bond’s yield represents the return an investor can expect to receive, factoring in both interest payments and any potential capital gains or losses.

Discuss the various components of a bond:

Components of a bond

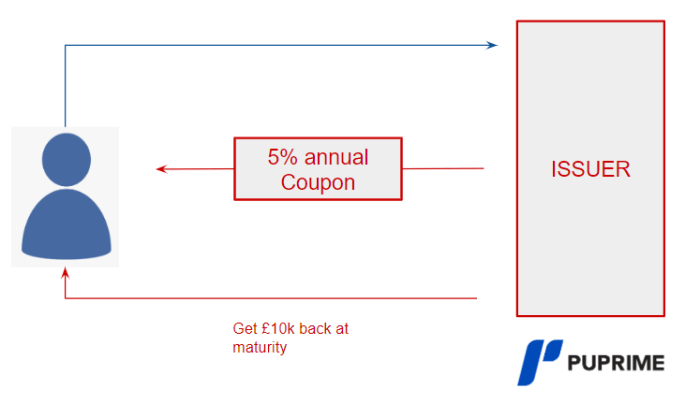

- Face value: The amount the issuer promises to repay the bondholder at maturity.

- Coupon rate: The annual interest rate that the issuer pays to the bondholder.

- Maturity date: The date when the issuer must repay the face value of the bond to the bondholder.

- Yield: The rate of return on a bond, taking into account its price and interest payments.

Share insights on the risks associated with investing in bonds:

Risks associated with investing in bonds

- Interest rate risk: The risk that changes in interest rates will affect the value of a bond.

- Credit risk: The risk that the issuer will be unable to make interest payments or repay the face value of the bond.

Types of bonds: What Are Bonds And How Do They Work

When it comes to investing in bonds, there are various types available to suit different investor preferences and risk profiles. Understanding the key differences between these types of bonds can help investors make informed decisions.

Fixed-rate bonds

Fixed-rate bonds, also known as plain vanilla bonds, pay a fixed interest rate over a specified period. These bonds are popular among conservative investors seeking predictable income streams. The main advantage of fixed-rate bonds is the certainty of interest payments, but they may be vulnerable to interest rate risk if rates rise.

Floating rate bonds, What are bonds and how do they work

Unlike fixed-rate bonds, floating rate bonds have variable interest rates that adjust periodically based on a reference rate, such as LIBOR or the prime rate. These bonds are designed to protect investors from interest rate fluctuations, making them suitable for those concerned about rising interest rates.

Zero-coupon bonds

Zero-coupon bonds do not pay regular interest like traditional bonds. Instead, they are issued at a discount to face value and redeemed at par value at maturity. Investors earn a return through the price appreciation of the bond. Zero-coupon bonds are ideal for investors looking to defer income and enjoy potential capital gains.

Convertible bonds

Convertible bonds give bondholders the option to convert their bonds into a predetermined number of shares of the issuer’s common stock. These bonds offer the potential for capital appreciation if the stock price rises, making them attractive to investors seeking both fixed income and equity exposure.

Government bonds, corporate bonds, and municipal bonds

Government bonds are issued by governments to fund public spending and are considered low-risk investments due to the backing of the government. Corporate bonds are issued by corporations to raise capital and offer higher yields but come with higher credit risk. Municipal bonds are issued by local governments and are tax-exempt, making them attractive to investors in higher tax brackets.

Advantages and disadvantages of investing in different types of bonds

Each type of bond has its own set of advantages and disadvantages. Fixed-rate bonds provide stability but may underperform in a rising rate environment. Floating rate bonds offer protection against interest rate risk but may have lower yields. Zero-coupon bonds can be tax-efficient but lack regular income. Convertible bonds offer a hybrid investment opportunity but may have limited upside potential.

Examples of when each type of bond would be suitable for an investor

– Fixed-rate bonds: Ideal for risk-averse investors seeking predictable income.

– Floating rate bonds: Suitable for investors concerned about rising interest rates.

– Zero-coupon bonds: Good for investors looking to defer income and capitalize on price appreciation.

– Convertible bonds: Attractive to investors seeking a balance of fixed income and equity exposure.

Bond market

The bond market is a crucial component of the global financial system, providing a platform for governments, corporations, and other entities to raise capital through debt issuance. It plays a significant role in enabling investors to diversify their portfolios and manage risk.

Bond Issuers, Bondholders, and Intermediaries

In the bond market, bond issuers are entities that borrow funds by issuing bonds to investors. These issuers can be governments, corporations, or municipal entities. Bondholders, on the other hand, are the investors who purchase these bonds and receive periodic interest payments as well as the principal amount at maturity.

Intermediaries such as investment banks, brokerage firms, and bond dealers facilitate the buying and selling of bonds in the market. They play a crucial role in matching buyers and sellers, providing liquidity, and ensuring efficient price discovery.

Bond Prices in the Secondary Market

Bond prices in the secondary market are determined by supply and demand dynamics. When demand for a particular bond increases, its price rises, and vice versa. Factors such as the bond’s credit rating, maturity date, prevailing interest rates, and overall market conditions influence bond prices.

Investors can buy and sell bonds in the secondary market at prices determined by market forces, which may differ from the bond’s face value. Bond prices fluctuate based on changes in interest rates, credit risk perceptions, and macroeconomic indicators.

Factors Influencing Bond Market Performance

Several factors can influence the performance of the bond market, including economic conditions, interest rate changes, inflation expectations, and geopolitical events. Economic indicators such as GDP growth, employment data, and inflation rates can impact bond prices and yields.

Interest rate changes by central banks can have a significant effect on bond prices, especially for fixed-income securities. In a rising interest rate environment, bond prices tend to decrease, while falling interest rates can lead to price appreciation for bonds.

Overall, the bond market’s performance is closely linked to broader economic trends and policy decisions, making it essential for investors to monitor these factors when investing in bonds.

In conclusion, bonds offer investors a unique opportunity to earn fixed income while supporting entities in need of financing. By grasping the intricacies of bond markets and the risks involved, individuals can make informed investment decisions that align with their financial goals.

When it comes to saving for college tuition, financial planning tips play a crucial role in ensuring a smooth journey towards your goal. By setting a budget, exploring scholarship opportunities, and considering a 529 plan, you can effectively prepare for the costs ahead. For more insights on how to manage your finances for higher education, check out this comprehensive guide on Saving for college tuition: Financial planning tips.

When it comes to saving for college tuition, financial planning is key. It is important to start early and set realistic goals to ensure you have enough funds when the time comes. Consider opening a 529 savings plan or a high-yield savings account to help grow your money over time. For more tips on how to effectively save for college tuition, check out this article on Saving for college tuition: Financial planning tips.